How Direct Air Capture Companies Make Money - 2/3

A 3-episode series diving on how those companies work, scale and have a global impact

Hello everyone! This is the second episode of series about Direct Air Capture describing Technology & Timing, Business Model & Scability (2nd post here) and finally the players (coming soon)

If you have missed the first edition, you can watch it:

or read it:

👋 Capturing carbon out of thin air costs between $600 and $1,000 per ton. So how do DAC companies even stay alive? Who pays the bill, and what does a “business model” look like for an industry that’s basically industrial-scale air filters?

Let’s break it down.

But wait, if you want to go further:

Sponsor this newsletter or one of my LinkedIn posts.

Be a guest on my podcast, book me for a conference, or something else? Work with Reactor.

Listen to the podcast, watch the YouTube channel, the TikTok and the Instagram

Join the free Reactor community on WhatsApp: deep tech and climate-tech entrepreneurs, events, and discussions.

Follow me on LinkedIn

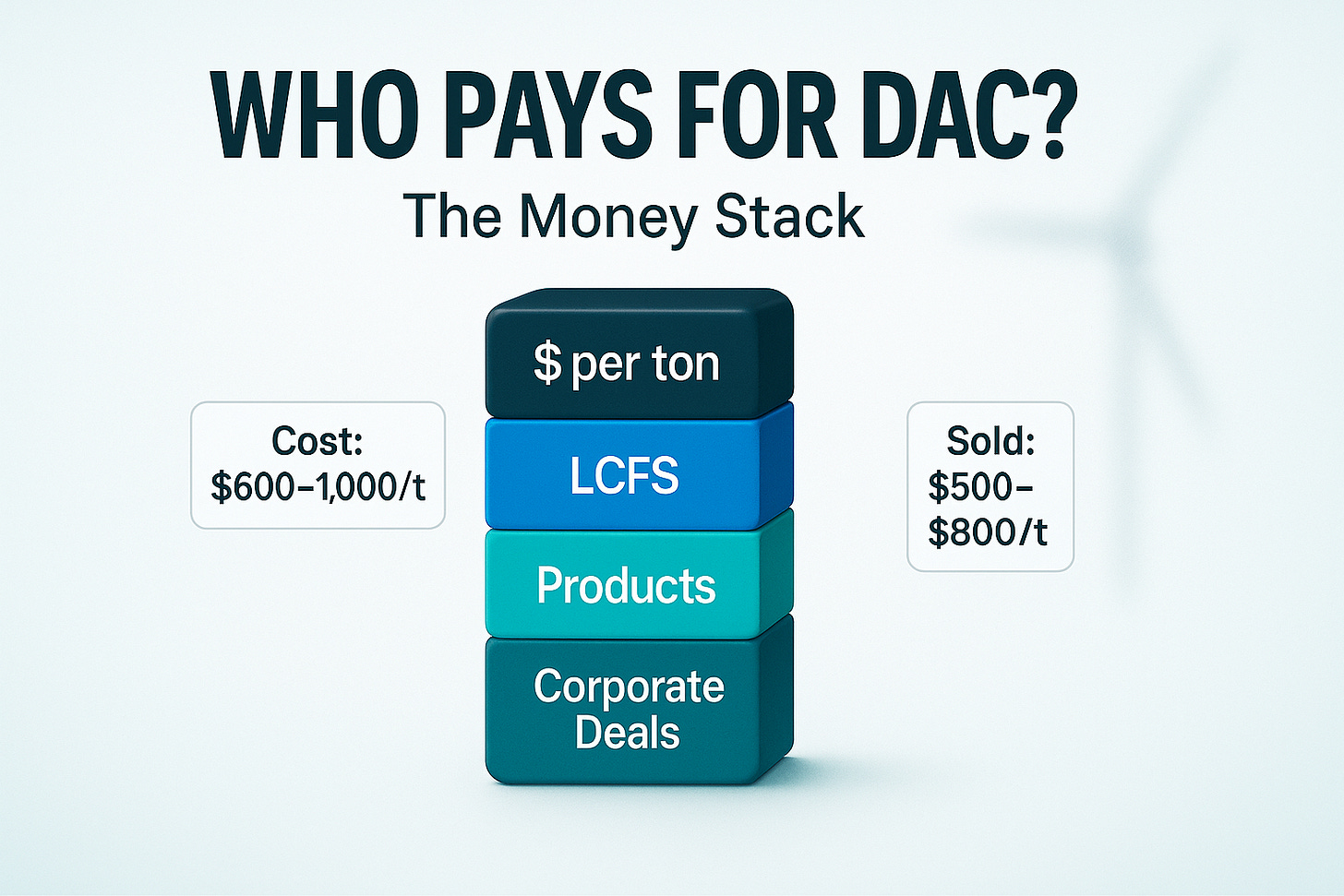

💵 The Revenue Streams

DAC companies stack revenue from a mix of markets and incentives:

Corporate offtakes (the voluntary carbon market).

Big buyers like Microsoft, JPMorgan, Amazon, and the Frontier coalition (Stripe, Shopify, Meta, Alphabet, etc.) sign multi-year contracts to buy tons of removal.

Example: Microsoft × Heirloom (up to 315,000 tons). JPMorgan × Climeworks (~25,000 tons, >$20M).

Why they pay: reputational value, net-zero targets, and durability — DAC credits are among the highest-quality offsets available.

U.S. 45Q tax credit.

Up to $180 per ton for DAC CO₂ stored underground, or $130/t if used in products.

Credits can be sold (transferred), which makes them financeable.

California LCFS (Low Carbon Fuel Standard).

If captured CO₂ is tied to fuels (e.g., for aviation), DAC can generate LCFS credits.

Value fluctuates but often >$100/t.

EU CRCF (Carbon Removal Certification Framework).

Europe’s “nutrition label” for removals. Doesn’t pay directly, but sets up quality and certification rules so removals can plug into future markets.

Utilization products.

Captured CO₂ can be used in synthetic fuels, concrete, chemicals.

This brings in product revenue, but only counts as a removal if the CO₂ is stored durably.

📊 The Unit Economics

Let’s do the math together.

Say a plant’s cost is $700 per ton today.

Subtract $180 from the U.S. 45Q tax credit.

That still leaves $520 per ton that must come from corporate offtakes, LCFS, or product sales.

That’s why early DAC credits are selling in the $500–$800 per ton range. Buyers know it’s expensive, but they’re paying to help scale.

🏭 The Business Model Archetypes

Here’s the truth: all DAC companies today rely on the same core business model — stack corporate offtake contracts with policy incentives (like 45Q in the U.S.) and add product revenue if possible.

The real differences lie in how they approach that same model:

Climeworks (Switzerland/Iceland/US) — Corporate-first with brand.

Pioneer in long-term offtakes (Microsoft, JPMorgan, Stripe/Frontier).

It also offers consumer subscriptions (“Pioneers”), making it the most visible B2C-facing DAC brand.

Still expensive, but building trust as the “premium removal” provider.

1PointFive / Occidental (US) — Integration with storage & fuels.

STRATOS in Texas (up to 500,000 t/yr).

Leverages Oxy’s existing business in pipelines and storage.

Focused on scaling mega-plants, with 45Q + corporate deals (Amazon, Airbus) + potential LCFS credits.

Heirloom (US) — Government-aligned scale-up.

First U.S. commercial DAC plant (Tracy, CA).

Anchor buyer: Microsoft.

Also part of DOE’s Project Cypress hub — positioning itself as the “hub-ready” partner for federal funding.

CarbonCapture Inc. (US) — Modular technology bet.

Containerized sorbent units designed for flexibility and scale-out.

Same revenue stack: offtakes + policy incentives.

Pitch to investors: lower risk and faster scale-up by mass-producing units rather than building giant plants from scratch.

⚠️ The Risks (Why It’s Hard to Scale)

Policy risk. If 45Q or LCFS are weakened, U.S. economics collapse.

Energy bottlenecks. DAC competes with data centers, hydrogen, and EVs for cheap, clean power. No clean energy to power DAC = no net removal.

Monitoring, Reporting, and Verification (MRV) Trust. MRV must be bulletproof. If buyers lose faith, demand collapses.

Capital intensity. Plants cost hundreds of millions upfront. Investors need long-term certainty.

Huge final Climeworks fundraising

📝 Key Takeaways

DAC companies don’t make money on “cheap credits.” They survive by stacking corporate offtakes + U.S. policy incentives + sometimes product sales.

Unit economics today mean losses or break-even, but buyers are deliberately overpaying to push the tech down the cost curve.

Different players have different bets: subscriptions, integration, mineral cycles, and modularity.

The risks are real — but so are the early revenues.

👉 Closing Tease

So now you know how DAC companies make money — at least for now. But who’s actually building this future? Next edition: a field guide to the startups and scale-ups racing to vacuum carbon out of the air.

📚 Resources for visuals & further reading

✨ That’s Reactor #2 — unpacking the money side of DAC.

Next up → Who’s who in the DAC race: the startups and scale-ups.

Struggling with filling your sales pipeline constantly?

When you are a startup, you look for leads.

You find some. You’re happy. You start taking care of them.

But you’ve neglected lead generation while you were taking care of them. There is no one left in the pipeline.

You get back to lead generation but you don’t take care of your existing customers. And the cycle starts again…

Do you see the problem?

The solution: lemlist.

I have been using lemlist for 3+ years, and this enables you to build multichannel lead generation campaigns - using LinkedIn, emails, calling, and WhatsApp.

With lemlist, you can book meetings with up to 30% of your cold prospects.

While most email finding tools on the market only locate 40 to 50% of contact information, the lemlist email finder and verifier can help you discover up to 80% of contact information.

lemlist has been revolutionizing sales as a leader in outreach tools since 2018. The tool allows you to build your lead list with verified emails, write and personalize at scale, and send multichannel campaigns that reach get. All in one tool.

With lemlist you can transform in seconds a generic template to a personalized email with lemlist text variables, personalized images or custom videos

Use advanced filters to gather leads from lemlist’s database of 450 million+ contacts — or pull info directly from LinkedIn profiles with lemlist Chrome extension.

Access lemlist's AI-powered B2B database of 450 million+ contacts and reach out to highly relevant leads 2x faster.

I have been lucky enough to have been selected as an official Lemlist affiliate. I highly recommend it to any climate tech startups out there. Click here to start using it. 14-day free trial.

Watch and listen to more Reactor: YouTube, Instagram, Podcast - Reactor, TikTok

Want more? Be a guest on my podcast, book me for a conference, or something else? : Work with Reactor.

Join the Reactor community on WhatsApp: deep tech and climate-tech entrepreneurs, events, discussions

💬 Have a story to share? Please message us to be featured in a future edition!

Let’s keep building the future of deeptech and climate tech. 🚀

Keep innovating,

Jérôme